Making Donor Advised Funds a Win for Your Organization

I recently presented a new whitepaper on Donor Advised Funds that I co-authored with my colleague Andrew Grumet from Polsinelli at the National Association of Charitable Gift Planners Annual Conference. Below is an overview of the whitepaper. If you are interested in learning more, I encourage you to review the full whitepaper and contact me with any questions.

Fundraising is simple. It is not easy, but it is simple. Effective fundraisers establish caring relationships with people (individuals), learn what is important to them, and to find ways to help them accomplish their goals for their family, themselves, and the charities and causes for which they care deeply. The Donor Advised Fund is a donor-centric tool that, properly used, can help a donor accomplish multiple goals, create an impact gift for multiple charities, all with a few simple forms and no legal work involved.

Simplicity. That is the power of the Donor Advised Fund.

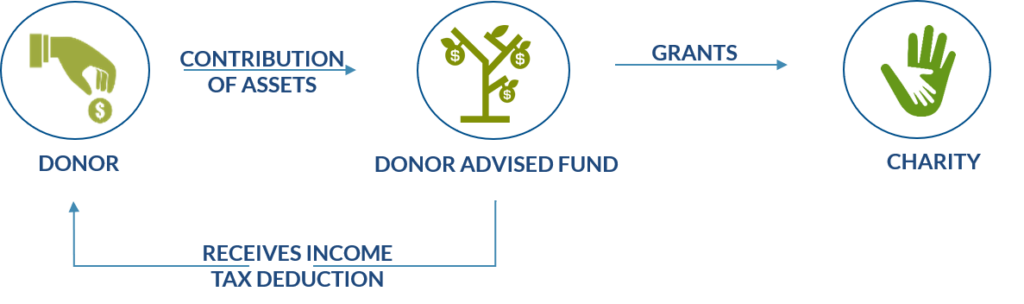

What is a Donor Advised Fund(DAF)?

A DAF is an account established with a qualified charity that permits the donor the right to make certain non-binding recommendations to the charity with respect to the fund’s administration.

Most people today establish DAFs with their financial advisor, rather than a gift officer employed by a charity. The financial advisor may attempt to make the concept of a DAF simpler by explaining that a DAF is like a “charitable savings account.” It is a special account with certain tax benefits that enables an investor to be more intentional and strategic about his/her/their giving.

DAF Benefits for a Donor

While total giving in the US has increased by 85% over the last decade and half, DAFs have seen a growth rate of more than twice that amount—190% in the last ten years alone. This is money that, presumably, would have gone to form new private foundations, further fund existing foundations or been given directly to charities that is now being held with investment firms, without a legal requirement for distribution.

- Targeted Philanthropy: Immediate tax deduction with the ability to distribute funds over time

- Legacy Planning: Easily incorporate multiple generations into philanthropic decision making

- Anonymity In Giving: Account name does not have to identify donor and grants can be given anonymously

- Low Maintenance: No ongoing upkeep of the account – no forms to file

- Growth Potential: Invested funds have the potential to grow over time

DAF Benefits for Nonprofits

Why do non-profits care about Donor Advised Funds? Because that is where the money is, and increasingly where the money is going. It allows a new opportunity to discuss with donors.

- Engagement: Deepen relationships with donors and learn more about their philanthropy

- Stewardship and Cultivation: Provide increased opportunities to steward donors and allow for more nuanced cultivation

- Donor-centric Programming: Offer an additional, multi-faceted giving vehicle to donors

- Endowment Support: Provide financial support to the organization’s endowment as well as other directed areas