Legacy Protection through Charitable Giving: An Overlooked Opportunity

Back in April, we set the stage of our current tax environment to give some background on a unique charitable giving strategy in our "Let's Talk Taxes" article. Today, we round out that idea.

Through the end of 2025, there is a legacy building, tax advantaged gifting opportunity that may be appropriate for your donors (and prospective donors) who:

- Earn more than $266,700 as an individual or $320,000 jointly

- Give more than $14,500 as a single taxpayer or $29,200 a joint filer

For donors who meet the above criteria and have a concentrated position of low-basis stock, this giving strategy may be of even greater interest.

This article will focus on converting Traditional IRAs to Roth IRAs (in whole, part, or over the course of many years) and offsetting the resulting tax obligation with gifts to charity. We will look at why donors may be motivated by this strategy, what the benefits are, what the downside is, and how charitable planning can make it a win-win-win for your donor, their children, and your organization.

We start by looking at legacy planning and the impact of the SECURE Act of 2019.

For many people who saved diligently in their employer sponsored retirement plan (401(k) or 403(b), etc.) or a traditional IRA (Individual Retirement Agreement), the SECURE Act may have had an impact on their legacy planning. When workers separate from employment, either because they leave a job or retire, most choose to roll what they saved in their employer sponsored plan into their own IRA.

Prior to 2019, if an IRA owner died leaving their IRA to a non-spousal beneficiary, that beneficiary could stretch required minimum distributions (RMDs) over their lifetimes, allowing the inherited IRA to grow tax-deferred for decades. This created an opportunity for people to pass their accumulated wealth on to future generations while limiting tax obligations for their heirs. This practice was commonly known as the “Stretch IRA.”

The SECURE Act and the "Stretch IRA"

The SECURE Act, enacted in 2019, significantly impacted the rules surrounding inherited IRAs. The SECURE Act eliminated the "stretch IRA" strategy, mandating that non-spousal beneficiaries must withdraw all assets from an inherited IRA within 10 years of the account owner's death.

This article explores the benefits of a Roth conversion to address that impact, and the strategic use of donations to optimize tax efficiency.

Roth IRA: A Superior Legacy Planning Tool

Given the changes imposed by the SECURE Act, a Roth IRA has become an increasingly attractive vehicle for legacy planning. Key advantages include:

- Tax-Free Distributions: Beneficiaries inherit a Roth IRA tax-free, reducing the overall tax burden.

- No RMDs for the Original Owner: Roth IRAs do not require required minimum distributions (RMDs) during the account owner's lifetime, allowing the entirety of the account to grow tax-free.

- Flexibility for Beneficiaries: Although beneficiaries must withdraw the assets within 10 years, they can do so without triggering income taxes, preserving more wealth for future generations.

(It is worth noting the account owner must remain living for 5 years post conversion for non-spousal beneficiaries to receive full tax benefits. Always consult your tax advisor.)

Converting a Traditional IRA to a Roth IRA

A Roth IRA offers significant tax advantages, particularly for high-income earners. While high income earners may be prohibited from making direct contributions to Roth IRAs, nothing precludes them from converting funds from a Traditional IRA to a Roth IRA. This is commonly known as a “backdoor Roth IRA strategy.”

Unlike Traditional IRAs, Roth IRAs provide tax-free growth and tax-free withdrawals in retirement.

Sounds great, right? Yes, but taxes must be paid.

Keep in mind that converting funds from a Traditional IRA to a Roth IRA incurs a tax obligation on the converted amount (ordinary income tax rates). This is where charitable giving can make this strategy advantageous.

I thought charitable giving was always tax advantageous. Why is this an ideal strategy only through the end of 2025?

The Pease Limitation, named after Congressman Donald Pease, was originally designed to reduce the value of itemized deductions for high-income taxpayers. This limitation was suspended under the Tax Cuts and Jobs Act (TCJA) of 2017 and is set to remain inactive until 2025. During this suspension period, high-income earners can maximize their itemized deductions without the Pease Limitation reducing their value.

The suspension of the Pease Limitation presents a unique opportunity for high-income earners to convert funds from a Traditional IRA to a Roth IRA while offsetting the associated tax obligations through charitable donations.

Offsetting Tax Obligations with Charitable Donations

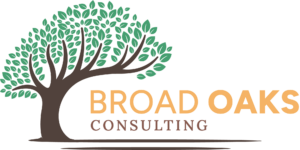

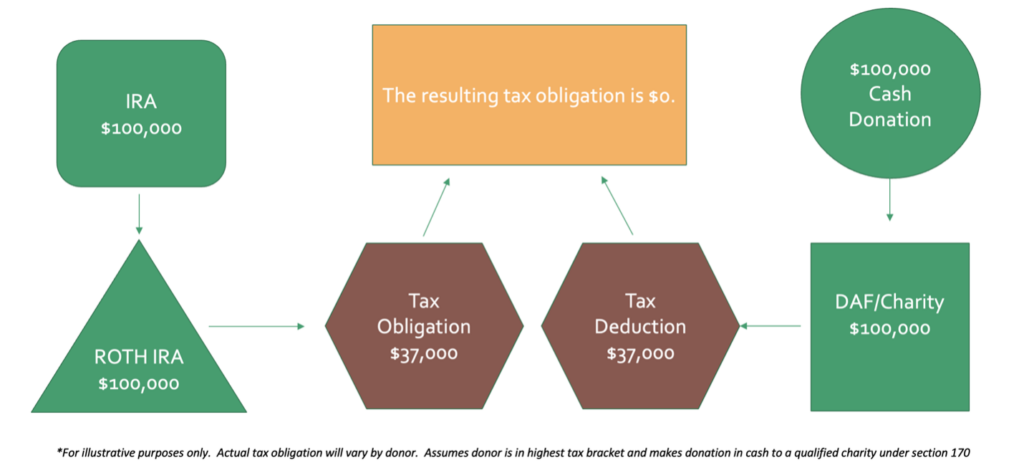

By donating to a charity or a Donor Advised Fund (DAF), high-income earners can leverage their philanthropic efforts to mitigate the tax burden of a Roth IRA conversion. Donations can be made in cash, appreciated securities, or any other instrument that is accepted by a DAF or charity of choice. For illustrative purposes, we will look at gifts of Cash and Appreciated Securities:

Cash Donations: Donors can deduct up to 60% of their adjusted gross income (AGI) for cash contributions to qualified charities.

Appreciated Securities: Donating appreciated securities allows donors to avoid capital gains taxes on the appreciation and deduct the fair market value of the securities, up to 30% of their AGI.

While the above numbers in the charts are for illustrative purposes only, it is entirely possible to eliminate nearly all of the tax burden resulting from a Roth conversion through charitable giving. It also creates an opportunity for your donor to become more intentional about their giving as well as their legacy. Working with donor's tax advisor becomes very important when utilizing this strategy.

The Sunset of the Pease Limitation Suspension

The Pease Limitation suspension is scheduled to sunset at the end of 2025. Post-2025, high-income earners will face a reduction in the value of their itemized deductions. This reintroduction will likely lead to a higher effective tax rate, making charitable contributions even more crucial for tax planning.

Charitable Giving After the Sunset

After the Pease Limitation suspension sunsets, high-income earners might consider the following strategies to maximize the tax benefits of charitable giving:

- Bunching Contributions: Combining multiple years' worth of charitable donations into a single year to exceed the standard deduction and maximize itemized deductions.

- Qualified Charitable Distributions (QCDs): For those over 70½, QCDs allow direct transfers from an IRA to a qualified charity, satisfying RMD requirements while excluding the distribution from taxable income.

- Donor-Advised Funds: DAFs offer flexibility in timing and investment growth of charitable donations, allowing for strategic planning of large contributions.

No Time Like the Present

The suspension of the Pease Limitation provides a strategic window for high-income earners to convert Traditional IRAs to Roth IRAs, leveraging charitable donations to offset the tax liability. The SECURE Act's impact on the "stretch IRA" makes Roth IRAs a more effective tool for legacy planning. As the sunset of the Pease Limitation approaches, high-income earners or those with a disproportionate amount of their wealth in a traditional IRA should talk to their tax advisor, financial advisor, and philanthropic advisor to create a coordinated plan to maximize their charitable giving, supporting their philanthropic goals, and take advantage of these timely tax benefits.

(Disclaimer: Neither Broad Oaks Consulting nor Angela Burgess is a CPA, attorney, or licensed wealth advisor/wealth manager. The above is neither a recommendation nor tax advice, but rather a practical summary and observations of studies. Organizations and individuals should consult with their own tax and legal advisors before making any financial decisions.)